Introduction

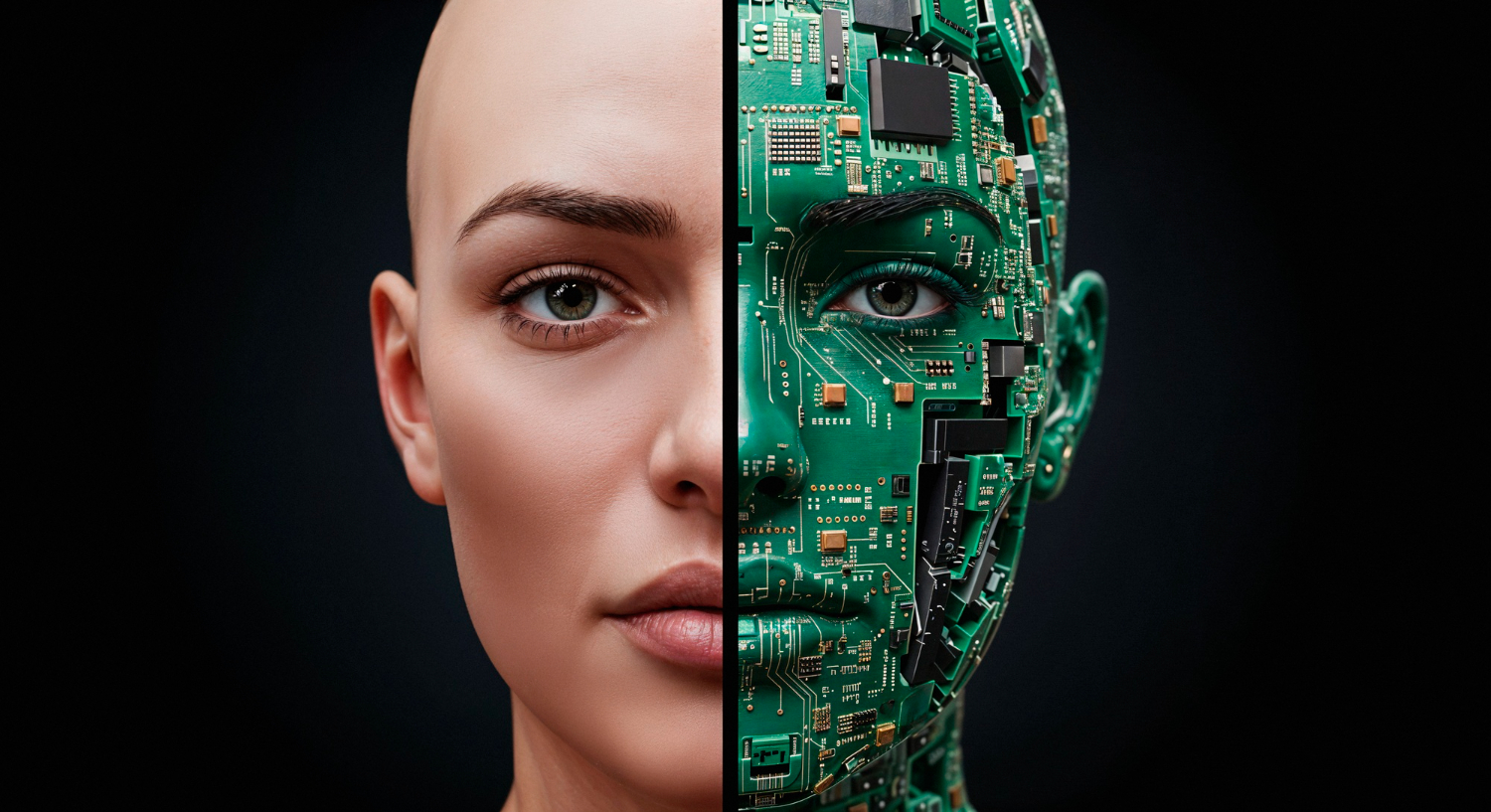

Artificial intelligence (AI) has significantly transformed the financial sector. Banks, insurance companies, and other financial institutions have adopted new technologies to streamline operations, enhance customer experiences, and improve security. Below are some of the key advantages of using artificial intelligence in finance, along with how TechnoLynx can assist in implementing these solutions.

Improved Decision-Making

Artificial intelligence enhances decision-making processes in finance. Algorithms can quickly analyse vast amounts of training data to deliver accurate insights. Financial institutions can use these insights to make informed decisions, whether it’s predicting market trends, evaluating loans, or identifying investment risks. Traditional computer systems can be slower, relying on human input for analysis. In contrast, AI-based tools provide faster, more accurate decisions, helping companies stay competitive in the market.

TechnoLynx specialises in creating systems that process data quickly and deliver actionable insights. Whether you’re looking to improve investment decisions or enhance risk management, our systems can help you gain the edge.

Enhanced Customer Service

Efficient customer service is crucial in the financial world. With the integration of virtual assistants and chatbots, financial institutions can now offer 24/7 support. These systems can handle basic queries such as account balances or transaction histories, freeing up human staff for more complex issues. Using speech recognition and natural language processing, chatbots can understand and respond to customers in real-time, enhancing the overall experience.

TechnoLynx develops intuitive virtual assistants that integrate with your existing customer service platforms. Our solutions provide quick, personalised responses to customer inquiries, improving satisfaction while reducing costs.

Improved Fraud Detection and Security

One of the most significant advantages of artificial intelligence in financial services is its ability to detect fraud more effectively. Systems equipped with advanced algorithms can monitor transactions in real time and identify unusual patterns that indicate fraud. This early detection prevents financial losses and enhances customer trust.

By processing large volumes of training data, these systems learn to differentiate between normal and suspicious behaviours. Companies like Google DeepMind have developed technology inspired by the human brain to detect irregularities more effectively.

At TechnoLynx, we offer solutions designed to detect fraud quickly and accurately. Our systems analyse data in real time, flagging potentially fraudulent activity before it causes damage.

Read our case study: Case Study - Fraud Detector Audit

Streamlined Risk Management and Compliance

Managing risk and ensuring compliance with regulations are critical in finance. Artificial intelligence has simplified these tasks. With the ability to monitor transactions and keep track of regulatory changes, companies can remain compliant without needing manual intervention. Algorithms also predict potential risks before they become issues, allowing companies to address them proactively.

Our compliance tools at TechnoLynx automate much of this process, ensuring your organisation meets regulatory requirements while also optimising risk management. By integrating real-time monitoring, we help you stay ahead of potential issues.

Personalised Financial Products

Artificial intelligence has enabled financial institutions to offer more personalised services. By analysing customer data, financial companies can create tailored solutions for individual clients. This level of personalisation helps build stronger relationships and increase customer loyalty. Whether it’s tailored loans, insurance policies, or investment options, these systems can recommend the most relevant products.

At TechnoLynx, we develop personalised solutions to enhance your customer engagement. Our algorithms are designed to analyse customer behaviour and preferences, allowing you to offer services that meet your clients’ exact needs.

Read more: Can Machines Make You a Millionaire? AI in Fintech

Automating Routine Tasks

Financial institutions can automate routine tasks using AI-powered tools. Whether it’s processing transactions or generating reports, automation reduces the workload for human staff. This allows companies to operate more efficiently, saving both time and money.

At TechnoLynx, we offer automation tools to handle a wide range of repetitive tasks. Our solutions are designed to integrate smoothly into your existing systems, allowing your team to focus on higher-value tasks.

Advancements in AI Technologies

AI technologies have evolved significantly over the years, especially with breakthroughs like Google DeepMind’s systems that mimic the human brain. These advancements have made it easier for financial institutions to analyse data, solve complex problems, and make more accurate predictions. Responsible AI is also becoming more important, ensuring that tools are ethical, fair, and transparent in their operations.

At TechnoLynx, we develop responsible systems that prioritise fairness and transparency. We ensure that our solutions are built on ethical principles, providing you with tools that you can trust.

Conclusion

Artificial intelligence has come a long way since coining the term in the mid-20th century. Since then, AI developers have continuously worked to create more sophisticated AI models that are capable of transforming industries, especially in financial services. These models can now analyse vast amounts of data, detect patterns, and make predictions far more efficiently than human operators ever could.

One of the key contributions of AI developers is their ability to fine-tune models using massive datasets, known as training data. This data allows AI systems to learn from past trends and make better-informed decisions in real-time. In the financial industry, this means AI can help assess risks, manage investments, and even detect fraud with unparalleled accuracy.

The advancements in AI models have also allowed institutions to create systems that are not just fast but also highly adaptable. These systems continuously evolve as they process more data, making them crucial for staying competitive in an ever-changing market. As AI becomes more integral to the financial world, AI developers play a pivotal role in shaping the future of banking, investments, and customer service.

TechnoLynx’s AI developers aim to deliver cutting-edge solutions tailored to the financial sector, ensuring your business stays ahead of the curve.

Artificial intelligence is reshaping the financial industry by enhancing decision-making, improving customer service, and boosting security. The ability to personalise financial products, manage risk, and automate tasks has made artificial intelligence indispensable for financial institutions. As AI technologies continue to advance, the opportunities for the financial sector will only grow.

At TechnoLynx, we are committed to providing innovative solutions that help your organisation stay competitive. Whether you’re looking to improve decision-making, detect fraud, or automate routine tasks, our systems are designed to meet the specific needs of your financial business. Contact us now to learn more!

Continue reading: Banking Beyond Boundaries with AI’s Magical Shot

Image credits: Freepik